What is Balance Billing? Knowing the Difference Between In-Network and Out-of-Network Providers Can Help You Avoid It

Health insurance can protect against large bills from health care providers, but in some cases, consumers with insurance face sizable bills. According to the Kaiser Family Foundation, in the past two years, 1-in-5 insured adults had an unexpected medical bill from an out-of-network health care provider.

Balance billing arises when a health care provider who isn't in your plan's network charges more than your policy pays. The provider often bills you for the difference or balance. Balance billing can occur when a consumer actively chooses to see a provider outside of their plan's network, such as a specialist physician.

It can also happen when a consumer has little or no choice in which provider renders services – also known as a "surprise bill." For instance, a patient might not get to select an in-network ambulance provider or pathologist to study lab samples. While you can't always avoid balance billing, understanding your health plan can reduce your chances of receiving a surprise bill. And your state may offer protections from surprise bills—check with your Department of Insurance (DOI).

IN-NETWORK VS OUT-OF-NETWORK

Balance billing is a risk when you get services from an out-of-network provider, so it helps to understand the difference between in-network and out-of-network providers.

- IN-NETWORK: In-network health care providers have negotiated a specific discounted rate with insurance companies; that way, insurers know how much care should cost. You can usually find who's in your plan's network on your insurer's website. The cost of services rendered by in-network providers can be predictable.

- OUT-OF-NETWORK: Out-of-network providers do not have an agreement with your health plan on the cost of their services. Payment for services from out-of-network providers could be covered, not covered at all, or partially-covered – exposing you to balance billing.

UNDERSTAND YOUR COVERAGE

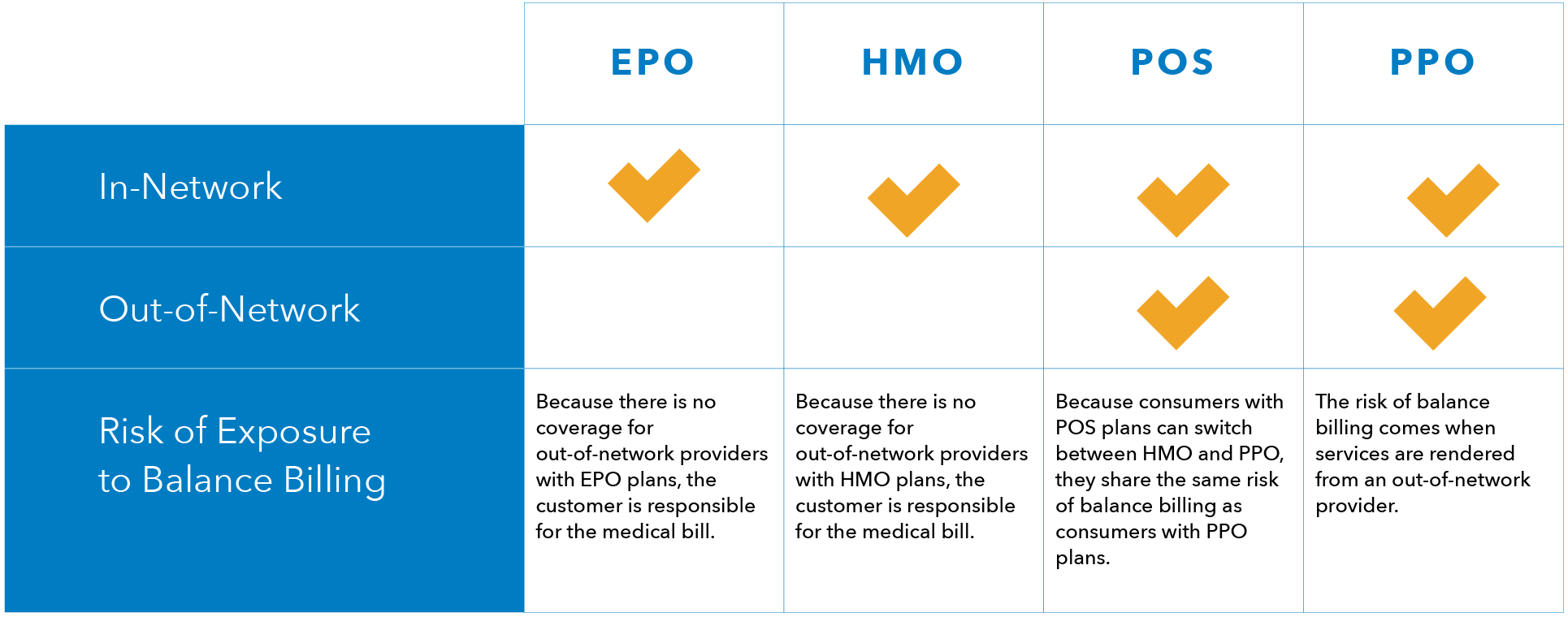

Your plan’s coverage for out-of-network services usually depends on its network type, so it’s essential to understand your coverage. Common network types include:

- EXCLUSIVE PROVIDER ORGANIZATION (EPO): A managed care plan where services are covered only if you use doctors, specialists, or hospitals in the plan's network (except in an emergency).

- HEALTH MAINTENANCE ORGANIZATION (HMO): A type of health insurance plan that usually limits coverage to care from doctors who work for or contract with the HMO. It generally won't cover out-of-network care except in an emergency. An HMO may require you to live or work in its service area to be eligible for coverage. HMOs often provide integrated care and focus on prevention and wellness.

- POINT OF SERVICE (POS): A type of plan where you pay less if you use doctors, hospitals, and other health care providers that belong to the plan's network. POS plans require you to get a referral from your primary care doctor to see a specialist.

- PREFERRED PROVIDER ORGANIZATION (PPO): A type of health plan where you pay less if you use providers in the plan's network. You can use doctors, hospitals, and providers outside of the network without a referral for an additional cost.

The table below displays the risk for exposure to balance billing under four types of health plans with in-network and out of network providers.

WHAT YOU SHOULD REMEMBER

Understand your health care coverage. PPO, HMO, POS, and EPO all have different in-network health care providers. Choose which coverage meets your medical needs and budget.

Know which health care providers are in-network and out-of-network. Planning ahead, when time permits, and staying within a plan's network can often save you from balance billing.

Your DOI and the National Association of Insurance Commissioners (NAIC) are here to help. States may have laws to protect you against balance billing. Learn more about health care coverage in NAIC’s Consumer Hub for Health Care Insurance.

Licensed agents, brokers, and companies are available to help you understand your plan and which providers are in-network and out-of-network. But, always check your DOI’s website to make sure the agent is licensed in your state.

About the National Association of Insurance Commissioners

As part of our state-based system of insurance regulation in the United States, the National Association of Insurance Commissioners (NAIC) provides expertise, data, and analysis for insurance commissioners to effectively regulate the industry and protect consumers. The U.S. standard-setting organization is governed by the chief insurance regulators from the 50 states, the District of Columbia and five U.S. territories. Through the NAIC, state insurance regulators establish standards and best practices, conduct peer reviews, and coordinate regulatory oversight. NAIC staff supports these efforts and represents the collective views of state regulators domestically and internationally.