NAIC Releases 2022 Insurance Department Resources Report

Two Volumes Contain Key Statistics on State Insurance Department Resources and Regulatory Activities

Today, the National Association of Insurance Commissioners (NAIC) released the 36th edition of the Insurance Department Resources Report (IDRR), which is developed primarily through an extensive survey of the NAIC Member states. Divided into two volumes, the report helps state insurance departments assess their resources in comparison to other states, and it details how state insurance departments manage available resources to effectively regulate an increasingly complex and competitive industry.

The IDRR's first volume contains information by state on the number of departmental staff and their functions, annual budgets, revenue flows, the number of insurers and insurance producers, and the number of consumer complaints and inquiries. It is organized into five sections: Staffing; Budget and Funding; Examination and Oversight; Insurance Producers; and Consumer Services and Antifraud.

The IDRR's second volume includes premium volume by type and state and demonstrates a healthy state-based insurance market for 2022.

An overview of Volume One's findings includes:

- There were 5,965 domestic U.S. insurers in 2022.

- Revenues collected increased 9.8% to $32.7 billion in 2022.

- State insurance departments received 282,567 official complaints and 1.5 million inquiries.

An overview of Volume Two's findings includes:

- Total premium collected nationally across all lines of business was $3.1 trillion, representing an increase of 6.4% over 2021.

- In terms of states with the most premium written in all lines of business, California is the leader, followed by New York, Texas, Florida, and Ohio, who collectively represent 40% of all insurance premiums in the nation

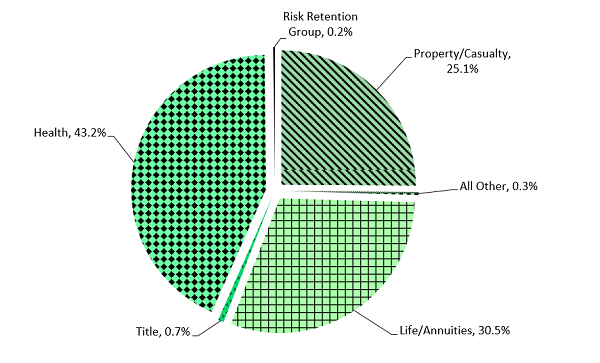

- Premium volume by lines of business for 2022:

As well as being a key assessment tool for state insurance departments, the IDRR serves as a helpful reference for state legislators, other financial regulators, and public policymakers.

About the National Association of Insurance Commissioners

As part of our state-based system of insurance regulation in the United States, the National Association of Insurance Commissioners (NAIC) provides expertise, data, and analysis for insurance commissioners to effectively regulate the industry and protect consumers. The U.S. standard-setting organization is governed by the chief insurance regulators from the 50 states, the District of Columbia and five U.S. territories. Through the NAIC, state insurance regulators establish standards and best practices, conduct peer reviews, and coordinate regulatory oversight. NAIC staff supports these efforts and represents the collective views of state regulators domestically and internationally.