Users of the UCAA application should read and review the UCAA instructions, FAQs and state charts prior to starting a UCAA application and BEFORE calling the states with questions that can be answered by information found on the UCAA web page.

| Description of Change | Posted Date |

| An FAQ was added to the Biographical Affidavit section regarding the "Applicant Company Name" when the bio. is being completed for a Form A filing. | 03/08/2021 |

| EDITORIAL: A new FAQ was added about associating additional NAIC company codes to a UCAA user ID. The new question was added under the General UCAA section as Q10. | 02/25/2021 |

| EDITORIAL: Biographical Affidavit (Form 11) Question 17 was modified. | 01/27/2020 |

FAQs were added for the enhancements made to the UCAA electronic application regarding:

|

11/24/2020 |

| EDITORIAL: Biographical Affidavit (Form 11) question 22 was modified to include TPA’s in the Other examples. | 05/06/2020 |

| EDITORIAL: Biographical Affidavit (Form 11) question 16 was modified. | 02/07/2020 |

| EDITORIAL: A clarification was added to the Form 11 – Biographical Affidavit regarding the formatting of the form due to lengthy or detailed responses. | 01/07/2020 |

| An FAQ was added to clarify how to complete the “Specify Purpose for Completion” section on page 1 and page 7 on the Biographical Affidavit (Form 11). | 12/16/2016 |

| Editorial: Biographical Affidavit (Form 11) questions 20 and 21 were modified. | 08/15/2019 |

| The General, Biographical Affidavit, Proforma and Electronic Application Frequently Asked Question were combined into one document. FAQ’s were modified and added. | 01/14/2019 |

| Questions 17 and 18 were added to the General FAQ’s regarding “Adding and Deleting Lines of Business.” | 06/26/2018 |

|

The Biographical Affidavit FAQ’s were revised to allow for acceptance of the biographical affidavit for six months from the original signature date and a new background report for updated biographical affidavit. Effective 1/1/2019 signatures on the biographical affidavit must be within 6-months of the application submission date. |

04/02/2018

06/22/2018 |

| The Biographical Affidavit FAQ’s – Question 1 and 3 were revised for the clarification of key managerial personnel who are required to file the biographical affidavit and language was added to require Disclaimer of Affiliation/Control for individuals with 10% or more beneficial ownership in the Applicant Company or the Applicant Company’s Ultimate Controlling Person. | 04/02/2018 |

| FAQ’s were developed for the Proforma and posted to the website. | 07/26/2017 |

| A new FAQ was added to the FAQ’s – Biographical Affidavits for memberships. | 06/22/2017 |

| FAQ’s 13-16 were revised and added for a Corporate Amendment – Merger of Two or More Foreign Insurers. | 12/09/2016 |

| A new FAQ was added to the FAQ’s – General for filing a merger application when the surviving company and non-surviving company are not authorized for the same lines of business. | 10/14/2016 |

|

Q1: ABC Mutual Insurance Company, a Texas domestic, wants to apply for a Certificate of Authority in Kansas. Which UCAA application should be completed? |

| Q2: Pretzel Insurance Company, a Florida domestic, wants to redomesticate to Indiana. Which UCAA application should be completed? A2: Primary Application - Redomestication. |

| Q3: The firm of Dewey, Cheetam & Howe would like to form a new insurer. Which UCAA application should be completed? A3: Primary Application. |

| Q4: Offshore Insurance Company, an alien insurer would like to utilize New York as a port of entry. Which application should be completed? A4: Primary Application. |

| Q5: How should the UCAA application be organized? A5: Refer to the UCAA webpage for the instructions by application type. These instructions are included under “How to File”. If the application is not prepared in accordance with those instructions, the application will be returned to you. |

| Q6: How does a Prescription Drug Plan (PDP) sponsor become licensed? A6: To become licensed, the PDP sponsor must complete a primary application and file the appropriate forms in hard copy to the Department of Insurance in which they are applying to be licensed in. The requirements for each state may be found at: www.naic.org/industry_ucaa.htm or State Specific Information For state-specific questions on PDP licensure contact the state directly, a list of state contacts is included through the link below: |

| Q7: When two companies are merging, which company is the Applicant Company? A7: The corporate amendment merger application should be filed under the surviving company’s name. If both companies are insurers, include the non-surviving company’s name in the drop-down field when a “merger” change type is selected within the electronic corporate amendment application. For internal state purposes, some states deem the Applicant Company to be the non-survivor. Check State Specific pages for more information prior to submitting the application. |

| Q8: Is the surviving company (Applicant Company) required to file an additional application (corporate amendment change type) with a merger application when the surviving and non-surviving companies are not authorized for the same lines of authority/business. A8: If the non-surviving company has more lines of business than the surviving company and the surviving company intends to write those lines of business, then the surviving company must also select the Adding or Deleting lines of business change type in conjunction to their merger application, to request the additional lines of business (Form 3) being transacted by the non-surviving company which the surviving company is not currently authorized to write. If the non-surviving company is authorized to write more lines of business than the surviving company and the surviving company does not intend to transact those lines, then a detailed explanation of how the company will run-off or handle those lines of business must be provided in a cover letter that would be included with the corporate amendment merger application. |

| Q9: What if the Applicant Company (survivor) is not licensed in the same states as the non-surviving entity? A9: The Applicant Company (survivor) will need to file an expansion application with the state and/or states in which it is not licensed but the non-surviving company is licensed in. For example, if the non-surviving company is licensed in Kansas and Missouri and the surviving company is only licensed in Missouri. The surviving company will need to submit an expansion application to Kansas. If the surviving company does not apply for a license in the non-surviving entity’s authorized state, it cannot transact business there and Form 17, Statement of Withdrawal, will need to be filed on behalf of the non-surviving entity. |

Electronic Application

| Q10: Is a separate UCAA user ID required for each legal insurance entity? A10: No, only one user ID is required and multiple cocodes can be associated to that ID. If your are completing a UCAA application for multiple companies within the same group and need additional cocodes added to your ID, email the cocode and company name to Jane Barr (jbarr@naic.org) or Crystal Brown (cbrown@naic.org). |

| Q11: Which applications can be filed electronically? A11: All foreign state applications can be filed electronically. This includes expansion applications and non-domiciliary corporate amendment applications. |

| Q12: What are the advantages to completing the UCAA application electronically? A12: a.) The electronic application is an information-based application as opposed to a form-based application. This means it will decrease the time and effort in completing the form by pre-populating duplicate information. b.) Allows for the completion of one application to be submitted to multiple states at one time. c.) Reduces correspondence requests through the UCAA email system. |

| Q13: Our company name has changed (XYZ Co.) but the electronic application shows the old company name (ABC Co), when is the company name updated? A13: Once your company has received domiciliary state approval for the name change and prior to beginning your corporate amendment application, forward a copy of the approval or new certificate of authority via email to Jennifer Heinz at jheinz@naic.org. |

| Q14: Our company name was changed in the NAIC database when the electronic application was started, however, the company name is now showing the old company name. Why is the old company name displaying in the application? A14: The company name is pulled into the electronic application via the NAIC database and is based on the company name provided on the Jurat page of the company’s most recent financial statement filing. Special attention should be paid to the timing of the corporate amendment application filing and the submission of the financial statement filing and/or amendments to the financial filings. If the electronic application reverts back to the old company name after the most recent financial filing has been submitted, email Jennifer Heinz at jehinz@naic.org to update the company name back to the new company name. |

| Q15: ABC Ins. Co. has merged with XYZ Ins. Co and XYZ Ins. Co. is the surviving insurance company. Should the NAIC be notified before beginning a corporate amendment application? A15: Yes, once approval of the merger has been received from your domiciliary state, copies of the approval should be sent to Jennifer Heinz at jheinz@naic.org prior to starting the application. |

| Q16: Our Company has redomesticated from Missouri to Kansas, however, the electronic application states that Kansas is not our domiciliary state. When is the domiciliary state updated? A16: Once your company has received approval from your new domestic state (KS) for the redomestication and acknowledgement from your old domestic state (MO), the new certificate of authority and approval letter, as well as the acknowledgment should be forwarded to Jennifer Heinz at jheinz@naic.org. |

| Q17: Our company is filing a change of control corporate amendment application as a result of a change in our ultimate controlling parent. Should the NAIC be notified of the change prior to beginning the corporate amendment application? A17: Yes, copies of the domiciliary state approval and a post-acquisition Schedule Y should be sent to Jennifer Heinz at jheinz@naic.org. |

| Q18: Why do the forms appear differently in the electronic application than the downloaded forms on the UCAA web site? A18: The electronic application is an information-based application. The forms are broken down by importance and duplicate information is pre-populated into the other forms automatically. To view the form in its entirety, select the view/print/download button on the main menu of the electronic application. |

| Q19: Where do I attach the files for the Public Records Package? A19: If the State does not require original signatures or certified copies then the attachments should be placed in the state specific requirements attachment button. Refer to the State Specific section on the UCAA home page. http://www.naic.org/industry_ucaa.htm |

| Q20: How should a document or attachment be named when uploaded into the electronic application? A20: To reduce a delay in the review of your application, it is extremely important to name your document with the appropriate identifiers. When applying to multiple states include the state abbreviation in the file name, for example: MO_Min_Cap_Surplus, to identify the minimum capital and surplus requirements for the state of Missouri. It is also important to include this title on the actual document; either as a footnote or header identifying the document when printed, so it is easily identifiable. The file name should not be longer than 32 characters, including spaces. For Example: Form 8_Q15 (E) to indicate a response to Form 8 Questionnaire, Question 15, Part E. |

| Q21: Should the President, Secretary or Treasurer each have a separate login to complete the electronic signature in the UCAA application on Form 2 and Form 12?

A21:The instructions state that one of the three officers must sign and attest to the application form (Form 2) and the Form 12 and Resolution require officer signature. The electronic application requires a signature by mark. The officer may have a separate log in or the company representative may complete the signature by mark on behalf of the officer. Note a copy of Form 2 or 12 can be printed and signed by the officer to be retained for your company records |

| Q22: Can an application be deleted from the electronic application? A22: Prior to submission, an application can be deleted by clicking on the trashcan icon  on the Application Selection screen. on the Application Selection screen.

After the initial submission, applications cannot be deleted |

| Q23: Can additional change types be added to a Corporate Amendment application? A23: No. The Change Type Selection screen is only available the first time you “Start” a Corporate Amendment application. If there are more change types to be added to the application, then the existing application should be deleted (if prior to submission) and a new one started to include all of the necessary change types. It is important to thoroughly read the corporate amendment instructions prior to starting a corporate amendment application. Change types cannot be added after an application has been submitted. |

Amending the Electronic Application

| Q24: When should I amend an application? A24: An application should be amended if your update changes the information on any UCAA form, the proforma or corporate record, not including state specific forms. When amending the application please note the following important information:

|

| Q25: I applied to multiple states and I’ve been requested to provide an updated attachment for a particular state even though half of the other states have already approved the application, should I amend the application for only one state? A25: No, when an electronic application is amended, the amendment will be for all states included in the original application. Rather than amend the application, an email with the attachment should be sent via the UCAA email system directly to the state requesting the information. |

| Q26: I submitted an application to several states but now want to withdraw my application to one or more of the selected states, do I used the amend application option? A26: No, once an application has been submitted a state cannot be removed. In order to withdraw your application, contact that state in question, make your request and the state should enter a “closed status” to reflect that the application has been withdrawn. |

|

Q27: Why will the electronic application not allow me to amend an application? If necessary, updated documents can be emailed to the state for review through the UCAA email system. If the application was previously denied or withdrawn, the user should start or clone (Expansion) a new application. |

| Q1: What does the section and item number mean on the Primary, Expansion and Corporate Amendment application checklist?

A1: The section refers to the filing requirement for each application type in the corresponding instructions. The item number corresponds with the Table of Contents under the filing requirements. It is important to always read the application instructions prior to beginning an application. |

| Q2: The checklist contains more items than my application requires. Do I still have to include every item on the checklist with my application?

A2: No. The checklist on the Primary and Corporate Amendment Application Checklists will contain more items than what may apply for your application type. The Primary checklist includes items for a primary application and a redomestication. A redomestication is for a company that is already licensed and has an NAIC cocode. A primary application is for a start-up company will not have a cocode The Corporate Amendment Checklist includes all required items for every corporate amendment change type, only the required items in the table of contents for the change type is required to be included on the checklist. |

| Q1: What if the surviving company wants to change its name to incorporate the names of both merged companies?

A1: The Applicant Company should also select the “name change” option for the corporate amendment change type. The new company name should be included on Form 2C for proposed new name of surviving Applicant Company. |

| Q1: When selecting “adding a line of business” can the Applicant Company select any line they wish to write in the foreign state?

A1: The Applicant Company should select only the lines of authority that they are authorized to write in their domestic state. |

| Q2: When requesting to delete a line of business in my domiciliary state, should I notify the foreign states if I’m licensed for the same line of business in the foreign state(s)?

A2: Yes, you should notify the foreign state via a corporate amendment Delete Lines of Business application. You must maintain authorization in your domestic state for any line you are authorized to transact in a foreign state. |

|

Q3: Why do certain lines of business have a strike through in the electronic application on the company input screen and PDF? A3:If a state has amended their lines of busines/statute prior to a company amending their application the company input screen will reflect the inactive lines of business with a strike through. The electronic PDF will show:

Applications that remain in their original submitted status will retain the lines of business and form revision date at the time of submission. Applications in a non-submitted status will always default to the most current active lines of business. The UCAA What’s New document will provide a detailed summary of the changes that will include: the state; the lines of business that changed; the revision date of the form; and that date that the change was posted. |

| Q4: Why are there differences between the electronic PDF of Form 3 and the PDF/Word file on the UCAA webpage?

A4:The reason for this difference is that currently the UCAA electronic application does not version. therefore, when a state makes a change to their lines of business and a company amends the application there will be a trackable version of the lines of business that changed from what was originally selected in the electronic application. The PDF/Word file on the UCAA webpage will always reflect the most current lines of business. |

| Q5: Our companies expansion application was submitted over 2 years ago to several states, if we voluntarily withdrew the application from 3 of those states shortly after submission can we amend the application to reapply to the states now?

A5: Applications can only be amended within two years of the original application submission date. Applications that have been withdrawn should not be amended. If an application has been withdrawn and the company wants to reapply to the state, a new application should be created. |

| Q1: Where do I attach the Certificate of Compliance (Form 6)?

A1: The Certificate of Compliance (Form 6) should be attached via the State Specific attachment button if your domiciliary state does not automatically complete the certificate electronically. Refer to the Certificate of Compliance and Certificate of Deposit Requirements chart for those states that utilize the electronic application for completing the certificates. The application checklist will only acknowledge Form 6 if it has been attached or completed electronically by the domiciliary state. The certificate will not be acknowledged or checked off on the checklist if the certificate is attached via the state specific attachment button. |

| Q1: Where do I attach the Certificate of Deposit (Form 7)?

A1:The Certificate of Deposit (Form 7) should be attached via the State Specific attachment button if your domiciliary state does not automatically complete the certificate electronically. Refer to the Certificate of Compliance and Certificate of Deposit Requirements chart for those states that utilize the electronic application for completing certificates. The application checklist will only acknowledge Form 7 if it has been attached or completed electronically by the domiciliary state. The certificate will not be acknowledged or checked off on the checklist if the certificate is attached via the state specific attachment button. |

| Q1: Regarding the Questionnaire, there are several questions that require a detailed explanation. Can I respond by saying, “Refer to the Narrative and/or to the Plan of Operation”?

A1:The goal of a Uniform State is to process a UCAA application within a specified timeframe that varies based on the type of UCAA application. The reviewing state loses much time when the response to a specific question has to be searched for. Please respond to these specific questions by attaching a written explanation to the Questionnaire for each question, which references the item number in the Questionnaire. The attachment should be labeled with the appropriate question number and alpha reference in the header or footer of the attachment if possible and the file name should also reference the appropriate question number. |

| Q2: Why is the electronic Questionnaire numbered differently than the downloaded version on the UCAA web site?

A2: The Questionnaire in the electronic application does not provide a question for the Proforma. The electronic application has a specific attachment button for the Proforma. The hardcopy will have one more additional numbered question than the electronic Questionnaire. |

The information contained in the Biographical Affidavit is used to evaluate the educational, employment and criminal history of the Affiant by the Department of Insurance. An Independent Third-Party, chosen by the Affiant from the list of vendors located on the UCAA website, performs a verification, and submits their results directly to the State Insurance Department(s) in the form of a Background Investigative Report. The results in the verification reports are used by the State Insurance Departments to assess competency, character, experience and integrity of the personnel responsible for the insurer.

Note, failure to disclose certain items in the Biographical Affidavit may increase the processing time of an application and slow an insurer’s speed to market. When in doubt, always disclose. If there is any doubt about the accuracy of an answer, the question should be answered in the positive and an explanation provided.

The formatting of the NAIC biographical affidavit, addendum pages and accompanying cover letter should NOT be altered, for lengthy or detailed responses refer to Question 22 below.

| Q1: Should I submit the UCAA even though the background reports are not complete? The background reports are expected to be delivered to the DOI within three to four weeks. A1: Yes, the biographical affidavits should be submitted with a completed application and the attached cover letter should indicate the that third-party background reports are expected to be delivered by XX date. Background reports should be delivered directly to the DOI within 4 weeks from the submission date of the application. |

| Q2: XYZ Insurance Company is part of a holding company whose stock is traded on the New York Stock Exchange (NYSE) or the NASDAQ stock market. According to the Proxy Statement of the holding company, a corporate entity owns 10% or more of the shares of stock of the holding company for investment purposes only. How do I file the biographical affidavits for this entity’s officers and directors? A2: A company has two choices: 1) provide biographical affidavits from each of the officers and directors of the corporate entity owning the shares; or 2) provide a copy of the Disclaimer of Control and Approval that were filed with the domiciliary regulator. A disclaimer generally consists of disclosing all manners of affiliation, including a.) the number of authorized, issued and outstanding voting securities held, b.) the number and percentage of shares of the holding company’s voting securities that are held of record or known to be beneficially owned by the person (or corporation) disclaiming control and all affiliates, and the number of such shares concerning which there is a right to acquire, directly or indirectly; c.) all other relationships and bases for affiliation between the holding company and the person (or corporation) disclaiming control and all affiliates of such person, including material contracts; and d.) a statement explaining why such person should not be considered to control the insurer. This information may have been previously filed with the Applicant Company’s domiciliary state as part of the insurer’s Holding Company Act Form B registration statement. If biographical affidavits are not provided, the reviewing state may request them during the course of the review. |

|

Q3: Who must submit the NAIC Biographical Affidavit and why is it necessary? The information contained in the NAIC Biographical Affidavit is used as a tool to perform an independent third-party verification where certain items must be verified. The independent third-party verification may contain information bearing on the Affiant’s character, general reputation, personal characteristics, mode of living and credit standing. The independent third-party verification shall be utilized to create a background report (the “Background Report”). An exception to the requirement for biographical affidavit is that individuals with a ten percent (10%) or more beneficial ownership in the Applicant Company or the Applicant Company’s ultimate controlling person (“Affiant”) should provide a copy of the Disclaimer of Affiliation/Control filed with the domiciliary state for the corporate entity and the action taken by the domiciliary regulator. A disclaimer generally consists of disclosing all manners of affiliation, including 1) the number of authorized, issued and outstanding voting securities held, 2) the number and percentage of shares of the holding company’s voting securities that are held of record or known to be beneficially owned by the person (or corporation) disclaiming control and all affiliates, and the number of such shares concerning which there is a right to acquire, directly or indirectly; 3) all other relationships and bases for affiliation between the holding company and the person (or corporation) disclaiming control and all affiliates of such person, including material contracts; and 4) a statement explaining why such person should not be considered to control the insurer. This information should have been previously filed with the company’s domiciliary state. If biographical affidavits are not provided, the reviewing state may request them during the course of the review. Refer to the state specific information link for states that cannot accept the domiciliary state’s disclaimer. |

| Q4: What type of information is requested in the NAIC Biographical Affidavit? A4: The NAIC Biographical Affidavit requests information with respect to the affiant's employment history, education, personal information and character. |

|

Q5: Can the Applicant Company use the same biographical affidavit previously submitted by an affiliate within the same group for a new UCAA application filing?

|

| Q6: Can a biographical affidavit, addendum pages and third-party background reports more than six months old be used in a new application? A6: No, affidavits, addendum pages and background reports more than six (6) months old are not acceptable. A newly completed biographical affidavit and addendum pages (if needed) with a current date must be submitted. A new background report would be required for the newly completed affidavit. Biographical affidavits signed within six months of the application submission date may be used for new applications for the same Applicant Company and/or affiliated companies that are under the same group code accompanied with a group cover letter. |

| Q7: Which Disclosure & Authorization Form should be utilized? A7: The NAIC Biographical Affidavit includes three types of Disclosure & Authorization Forms based on certain state laws, regulations and rules, the wording is altered to meet the state's requirement. An Affiant must sign the corresponding Disclosure & Authorization Form(s) for the respective state(s) where the affiant has lived or worked within the last ten (10) years. Refer to the Disclosure & Authorization Forms for further information. |

| Q8: Is the biographical affidavit required to be notarized when the affidavit is signed? A8: Yes, the date of the affiant’s signature and the date of the notary’s signature should be the same date. |

| Q9: How long is the Disclosure & Authorization Form valid? A9: The Disclosure & Authorization Form is valid for a maximum of six (6) months from the signature date. Additionally, an Affiant may revoke the authorization at any time by delivering a written revocation to the Applicant Company. Refer to the Disclosure & Authorization Form for further information. |

|

Q10: Are the Background Reports subject to the Fair Credit Reporting Act? Applicants and state Insurance Departments are required to comply with FCRA, especially as it relates to confidentiality of the information contained in such consumer reports. To the extent required by law, the Background Reports procured under the Disclosure & Authorization Form should be maintained as confidential. A copy of FCRA can be found at: https://templates.legal/fair-credit-reporting-act/ |

| Q11: Who is permitted to receive a copy of the Background Report? A11: The Background Report is submitted directly to the Insurance Department in any state where an Applicant Company files or intends to file an application, and to the Applicant Company. Affiants, who desire a copy of their Background Report, may request a copy from the Applicant Company or the consumer reporting agency (‘CRA”) as indicated on the Disclosure & Authorization Form. Refer to the Disclosure & Authorization Form for further information. |

| Q12: Is any other information or documentation required to be submitted to a state Insurance Department? A12: Please check the Fingerprint and Biographical Affidavit Requirements chart or state specific information for additional requirements, such as fingerprint cards and processing fees. |

| Q13: What is an Independent Third-Party? A13: Independent Third-Party is defined as: (a) A consumer reporting agency (“CRA”) by the Federal Trade Commission (“FTC”) and therefore subject to the FCRA, which have been vetted and currently listed on the approved list; (b) Has the ability to perform international background investigations; and (c) One whose officers and directors have no material affiliation with the Applicant Company other than stock ownership amounting to less than 1% of total stock outstanding, unless prior approval is given by the department of insurance to which application is being made; and (d) Has agreed to comply with the NAIC Background Reporting Best Practices and Guidelines. |

|

Q14: Does it matter which agency I use for obtaining an independent third-party background report? It is the Applicant Company’s responsibility to choose an appropriate agency from the NAIC list; one whose officers and directors have no material affiliation with the Applicant Company other than stock ownership amounting to less than 1% of total stock outstanding, unless prior approval is given by the department of insurance to which application is being made. |

| Q15: Is it necessary to submit the NAIC Biographical Affidavit for a new officer, director or key managerial position? A15: Some states require the NAIC Biographical Affidavit for a change in key managerial positions or for a new officer or director. Please refer to the chart located on the NAIC website for Fingerprint and Biographical Affidavit Requirements. Requirements after licensure are listed on the right-hand side of the chart. |

| Q16: Can one biographical affidavit be submitted for the affiant if they are an officer and/or director of multiple companies within the same group? A16: Most states will allow for one biographical affidavit (with one company name) to be submitted with the NAIC biographical affidavit group cover letter attached that includes the additional company names and positions held by the affiant for annual updates or new director/officer changes. Refer to the Fingerprints and Biographical Affidavit Requirements chart on which states will not allow for a cover letter. |

| Q17: The NAIC Biographical Affidavit was recently amended, will the states still accept the previous version, or will I need to redo all previously completed biographical affidavits? A17: The uniform states are aware that, from time to time, the forms may be amended by the National Treatment and Coordination (E) Working Group and that a transition period may be acceptable. When using a previously posted form, the affiant’s signature date should be prior to the revision date or as close to the revision date as possible (within two weeks). Affidavits signed more than two weeks after the form’s posting date must use the most current biographical affidavit form posted on the NAIC website and obtain new signatures. |

| Q18: Where do I attach the Biographical Affidavit within the electronic application? A18: The Biographical Affidavit should be attached via the Biographical Affidavit attachment button located under the Attach/View General Attachments link. Be sure to name your files appropriately so they are easily identified. The file name should include the name and title of the affiant, i.e. officer, director, etc. |

| Q19: The NAIC biographical affidavit group cover letter does not allow enough space to include all of the companies that the affiant is an officer/director of. What should I do? A19: Addendum pages are included within the biographical affidavit group cover letter to be used for additional companies carried over from the first page of the group cover letter. If the addendum pages are not utilized or are blank, they should not be submitted with the group cover letter. |

Completing the Biographical Affidavit

| Q20: Is it acceptable to leave a question or item blank if I don’t know the answer, or if the question or item does not apply, or that the answer is none? A20: No, you must answer each and every question or item. If the answer is none or no, state “No” or “None”. By not responding to each question or item, the various State Insurance Departments may request an updated affidavit regarding the missing question or item. A deficient or incomplete biographical affidavit submitted for a Background Report could result in a delay of the application review process. |

| Q21: I am completing a primary application. We do not yet know the address and telephone number of the insurer. What information should I include? A21: Following the name of the present or proposed entity, insert, “To be determined” as your answer. |

| Q22: The form does not allow enough space to respond to the questions or items. What should I do? A22: Addendum pages are available as Form 11b and are to be used for additional responses carried over from the affidavit. Only the NAIC addendum templates can be submitted, individual company addendum pages will not be accepted. There are seven addendum templates: Residence, Education, Employment History, Licenses, Professional Societies/Associations, General and Blank. Cross-reference and label your responses to the biographical affidavit question or item number when utilizing the General or Blank addendum pages. Addendum pages should be signed by the affiant. Addendum pages are not required to be submitted with the affidavit if they are not utilized. Currently, addendum pages cannot be combined with the biographical affidavit. The biographical affidavit and addendum pages can be uploaded into the electronic application as separate attachments. Each form should be labeled to clearly identify the forms for the affiant, such as, John Smith - CEO - Bio and John Smith - CEO - Add. 1, 2, etc. |

| Q23: The addendum pages include Page ___ of ___ below the signature line. What should be included here? A23: Because the affiant may have multiple pages included in the addendum and may even need to download several copies to allow for enough space, the intent is to provide page numbers for printing purposes. |

|

Q24: When the question or item requires that I attach a copy of the complaint or settlement document or other similar document, do I need to just include it with the Biographical Affidavit? If attachments are included as addendums, then attachments must also be labeled accordingly and signed by the affiant. |

|

Q25: What name should be listed in the “Applicant Company Name” field when the Biographical Affidavit is being completed in conjunction with a Form A filing?

The Acquiring Company should be listed as the Applicant Company Name within the body of the Biographical Affidavit, since the affidavit specifically states: “In connection with the above-named entity, I herewith make representations and supply information about myself as hereinafter set forth.” |

Biographical Affidavit Questions:

|

Specify Purpose for Completion Q26: What should be included in the “Specify Purpose for Completion” section on Page 1 and Page 7? Check marks would not be considered an acceptable response. |

|

Item 1a Q27: I never utilize my full name. I always utilize my initials when signing documents in an official capacity. No one would recognize me if I complete the form as indicated. |

|

Item 2a Q28: I was a citizen of the United States and moved to another country where I am now a citizen. I don’t know if I am still a citizen of the United States or not. How should I respond to this question? |

|

Item 2b Q29: I have citizenship in several countries. Do I have to list all of the countries? |

|

Item 3 Q30: I have several occupations. Item 4 of the Biographical Affidavit does not appear to allow for this. How should I respond? |

|

Item 4 Q31: I have several businesses with various addresses, but primarily work out of my home. Which address or addresses should I utilize? |

|

Item 4 Q32: I primarily work out of my home in New Jersey, though the business is located in New York. Which telephone number should I utilize? |

|

Item 5 Q33: I do not recall the exact dates that I attended college. Can I just guess? |

|

Item 5 Q34: What should be listed in “Other Training”? For example, I took some classes and received a certification to administer CPR and also to teach aerobics. Should I list this training? |

|

Item 5 Q35: I do not recall the telephone number of the foreign school that I attended. Can I just leave this information off the form? |

|

Item 5 Q36: How are multiple schools listed in the Education and Training section for: undergraduate, graduate, and other training? |

|

Item 6 Q37: I used to be a member of a professional association. Do I still need to list the name of the association even though I am no longer active? |

|

Item 6 Q38: I am not a member of a professional society or association. Can I just leave this item blank? |

| Item 6 Q39: I am active in my community and am a member of several community associations. Do I list them all? A39: No, only list memberships that pertain to your current or past occupation. State “None” if your answer is none. |

|

Item 7 Q40: I have been asked to be a director of the company, I anticipate being named an officer in the immediate future. How should I respond to this item? |

|

Item 8 Q41: I do not want my current employer to be contacted as part of the verification or background investigative process. Do I still have to provide the information? |

|

Item 8 Q42: I do not have the fax number or telephone number of the entity that I worked for 18 years ago. I do not even know if the entity is still in business. What should I do? |

|

Item 9a Q43: It was 20 years ago that I was in a position that required a fidelity bond and there was a claim made on the bond, but I was not personally named in the claim. Do I have to disclose the information? |

|

Item 10 Q44: I do not know the telephone number of the Securities and Exchange Commission. Can I just leave the space next to Non-Insurance Regulatory Phone Number blank? |

|

Item 10 Q45: Thirty years ago, I held a Broker’s license while I was working at Lloyds of London. I do not recall the license number, whether it has expired, the address of the issuer or the license, etc. Should I reflect this license on the form, even though I have such limited information surrounding the license? |

|

Item 11d Q46: Over 30 years ago, when I was a teenager, I was arrested and charged with Driving Under the Influence (“DUI”). Do I have to disclose this? |

|

Item 11d Q47: When I was 19, I walked out of a store with an item, it was an accident, but I was charged with shoplifting. The charges were ultimately dropped, and I believe my record was expunged and besides, it happened so long ago when I was a youngster. Do I need to disclose? |

|

Item 11h Q48: We had an employee that sued the company five years ago regarding alleged unpaid wages. The company was named in the suit, as well as me and two other directors. Do I need to disclose this matter? |

|

Item 11i Q49: I was personally involved in violating a small loan law, not intentionally; however, an official other than the Comptroller alleged the violation. Do I need to disclose this matter since the party alleging the violation was not a “Comptroller”, per se? |

|

Item 11j Q50: When I went through my divorce, a foreclosure action was filed against me and my wife with regards to our home. It was not all my fault. Do I need to disclose this, especially since my wife was also named? |

|

Item 12 Q51: I have established a Trust for each of my minor children to hold the stock of our family owned insurance company until they are 21 years of age. There are three children, and each child holds 13% of the stock. I am just Trustee, my ownership is 5%, but I can vote the children’s stock. Do I have to disclose this? |

|

Item 13 Q52: Within the holding company system, I own shares of stock of our Claims Management Company, a Managing General Agency, A Risk Management Company and a Computer Software Company. What do I need to disclose, if anything? My direct ownership percentage is 5% for each entity. Do I need to disclose anything? |

|

Item 14 Q53: I am personally in the midst of a bankruptcy proceeding at this time. Do I need to disclose the proceeding; it is still ongoing. |

|

Item 14 Q54: I have worked for multiple entities over the course of my career that were controlled by various holding companies or groups. Do I need to provide every group code for the companies in which I was an officer or director, trustee, investment committee member key management employee or controlling stockholder? |

|

Item 15a Q55: Prior to my being promoted to a key managerial position within the company, the company had its Certificate of Authority denied in Puerto Rico. This occurred six months ago. My promotion occurred last month. Do I need to disclose this information? |

|

Item 15b Q56: Six months after I left the XYZ Insurance Company, where I held the position of Director, the company had their Certificate of Authority suspended, but it occurred twelve (12) years ago. Do I need to disclose? |

|

Item 15c Q57: Do I need to disclose market conduct fines imposed by the various State Insurance Departments? We had an incident where we utilized an unapproved form; 12 states fined us. This is a lot of information to disclose. What should we do? |

Biographical Affidavit Questions – Supplemental Personal Information:

|

Item 2a Q58: I have been married several times. Do I have to list all my former names? |

|

Item 2b Q59: Do I need to include just my nickname? For example, my peers know me as J.R., not John Robert Smith. Do I need to just fill in J.R. or J.R. Smith? |

|

Item 2b Q60: I have utilized several aliases throughout the years. I prefer to keep this information confidential. Am I required to disclose this information? |

|

Q1: Is an email address required on Form 12? A1: Yes. If the form asks for an email address, then the applicant should provide one. |

|

Q2: What information should be included on Exhibit B of the Uniform Consent to Service of Process? A2: Refer to Exhibit A for the Consent to Service of Process for the state requirement. If required, provide the resident agent information; otherwise, include the company’s home/statutory address if the state insurance commissioner is to receive the Service of Process on Exhibit B. This is the contact information that will be used to forward the Service of Process to the company. |

|

Q3: What do the dates mean on the Resolution Authorizing Appointment of Attorney? A3: The resolution date is the date that the Board of Directors gave authority, unless otherwise stated, to the president or secretary of the company to authorize the Uniform Consent to Service of Process. The resolution adopted effective date is the same date as the resolution date or date designated by the Board of Directors. The authorization date is the date that the Board of Directors met and would be included in their minutes. The authorization date could be the same or different than the resolution date and resolution adopted effective date. |

The proforma is one of three components in the Plan of Operation. The information contained within the proforma is used to project balance sheet and income statement amounts for companies who are forming a new insurer or redomesticating to a new state (primary application), expanding into a new state (expansion application) or amending their certificate of authority (corporate amendment – adding lines of business or merger of two or more foreign insurers, or change of control of foreign insurer). The proforma should include three full years of projected data that is relevant to the Applicant Company’s history of growth and losses. The proforma excel spreadsheets and additional instructions are included on the UCAA website.

Intro Tab:

|

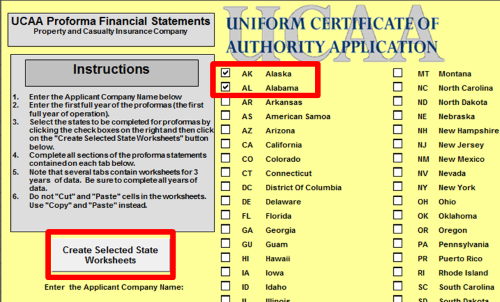

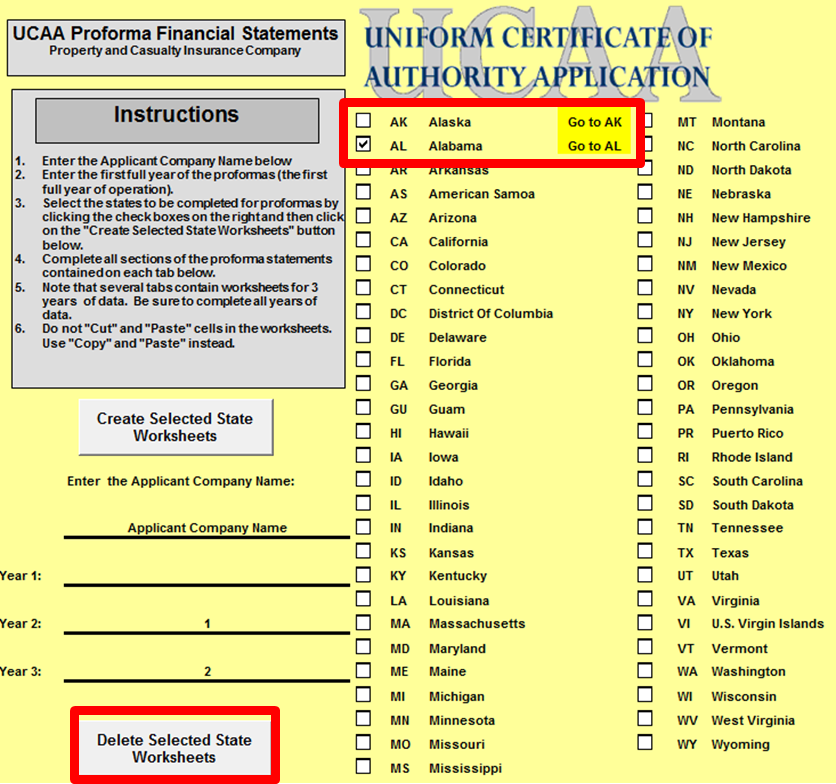

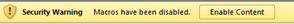

Q1: What does the Security Warning A1: Yes, the “Enable Content” button allows the necessary macros to run on each state page created. |

|

Q2: Where and what years are entered for the proforma being completed? A2: The Intro tab lists a table for years 1-3. Enter the first full year YYYY in the Year 1 line. The Year 2 and Year 3 will then populate with the next two consecutive years. These years will populate to the other pages of the proforma workbook. For example, if 2017 is entered in Year 1, then Year 2 and Year 3 will populate with 2018 and 2019. |

|

Q3: How are the individual state pages created for premiums and losses? A3: Select the check box next to each applicant state. After selecting the states, click on the Create Selected State Worksheets button. This will run the macros and create an individual state page for selected state. Hyperlinks will also be listed next to each state name on the Intro tab that will take the user directly to that state worksheet. |

|

Q4: How do I delete a state page? A4: If a state page is created in error, click on the check box of the state that needs to be deleted and then click on the Delete Selected State Worksheets button. A warning screen will display, with an x next to the state(s) that are to be deleted. Confirm that the state page should be deleted. Click Yes to confirm. The macros will run and the selected state(s) page(s) will be removed. |

Balance Sheet:

|

Q5: What does the balance sheet provide? A5: The balance sheet provides regulators with a high-level review of the type and quality of assets that the Applicant Company holds, including the asset mix and liquidity levels and liabilities. |

|

Q6: Should projected reserves be included? A6: Projected reserves should be provided in concert with the appropriate actuarial methodologies and provided assumptions. |

|

Q7: What should the Capital and Surplus amounts reflect? A7: Capital and surplus amounts should meet the requirements of the applicant state(s) where the Applicant Company is seeking admission or licensure. It is recommended that the Applicant Company’s initially funded capital and surplus reflect the amount needed in its first year of projected data. Be advised, that a state’s required minimum capital and surplus quality in cash or cash equivalents should be considered non-working capital. Funds in excess of the minimum capital requirements needed to operate the Applicant Company i.e. claim payments, claim handling expenses, and any other expenses that may be required prior to admission/licensure. |

|

Q8: Is a projected Risk Based Capital (RBC) required? A8: Yes, the total capital and surplus and authorized control level amount must be included on the balance sheet page. These amounts will then be used to calculate the projected RBC ratio. Any RBC ratio below 300% will be considered a hazardous financial condition |

P & L Statement:

|

Q9: Are expenses included in the P&L page? A9: Yes, the nationwide P&L page should include the expenses. |

Premium Ratios:

|

Q10: What is the purpose of the Premium Ratio worksheet? A10: Premium ratios are an important regulatory tool that allows regulators to analyze and evaluate the Applicant Company’s writing leverage and how much an Applicant Company relies on reinsurance. |

|

Q11: What should be included on the assumptions page? A11: The Assumptions page should provide an explanation of the assumptions used by the Applicant Company to project amounts reported in the proforma. Such as, estimated premiums and claims amounts. Changes and alterations to amounts reported in the proforma should also be included in the assumptions page. The assumptions page should include the name and credentials of the person preparing the projections. The health proforma should include a schedule, charges or other information that addresses the rates and premiums used to establish written and earned premium. |

|

Q12: What should be included on the state pages? A12: For Expansion and Primary applications, the state pages should include all of the lines of business in which the company is applying for permission to write. For corporate amendment applications, the state pages should include all business that is currently being written and any lines that are being applied for permission to write. |

Nationwide Premium by LOB (Aggregate of Authorized & Expansion/Add LOB):

|

Q13: What should be included in the nationwide page? A13: The nationwide page will calculate automatically based on the authorized and state page worksheets. The authorized and state tabs include projected premiums by line of business for a three-year period. The authorized tab will include those states in which the company is already licensed and authorized to write business and the state tabs will include three years of projected premiums by line of business for those states in which the company is applying to be licensed and authorized. |

|

Q14: What should be included in the nationwide projections? A14: Nationwide Premiums by LOB (as expressed by line of business) should support the aggregate numbers reflected in the projected financial statements as an aggregate of projected activity in all States (both where the Applicant Company is applying and actively operating). |

|

Q15: What information should be included in the state pages? A15: Each state’s projection (State Tab) as expressed by line of business should reflect activity only relevant for the state(s) where the Applicant Company is applying. Each state tab represents the business that is being applied to write and/or the company is authorized to write will be written in that state. Each applicant state is concerned with their individual state and the overall nationwide business of the Applicant Company. |

Tips and Tricks:

|

Q16: What if a state requires more than three years of projected data? A16: If an applicant state requires more than three years of projected data, add the remaining years to a separate proforma workbook for that state. |

|

Q17: Our company plans to begin writing business on June 1. What years should be used in the proforma? A17: The proforma should include three full years of business. The state may want a partial year projection if the company plans to write for a partial year. An additional explanation on when the company plans to begin writing business can be included in the assumptions section of the proforma and in the plan of operation. |

|

Q18: Is a proforma needed for a Corporate Amendment – Deleting Lines of Business application? A18: A proforma is not required for a Corporate Amendment – Deleting Lines of Business application unless specifically requested by the applicant state. However, the Applicant Company must prove/indicate that all liabilities related to that line of business have been extinguished prior to applying for deletion of the line. |

|

Q19: Why is the proforma needed for a Corporate Amendment – Merger of Two of More Foreign Insurers application? A19: The proforma is needed to show the assets, liabilities and writings of the merged surviving company. It should reflect the increase in liabilities taken on by the surviving company. |

|

Q20: Our company is licensed in only one state but writes business as a surplus line’s insurer in other states. We are now looking to expand into a new state as a licensed insurer. Should we only include business written for the states in which we are licensed, or should we also include the business written as a surplus line’s insurer in the proforma? A20: Include all business written, including business written on a surplus line’s basis. For regulatory review purposes, all business written that affects the insurer’s bottom line should be included in the proforma. |

|

Q21: Who should complete the proforma? A21: The proforma should be completed by statutory accounting or financial reporting professionals that should be available to answer any questions or concerns from reviewing regulatory staff. |

|

Q22: How long is the proforma valid? A22: Proformas should be valid during the course of the review but may be used by regulators to compare an Applicant Company’s performance following admission/licensure. The proforma should be submitted based on current estimates projecting the first three years of business. If the application review continues into the following year, or other changes occur, new financials and proforma information may need to be submitted to the state. |

|

Q23: What proforma workbook should be used? A23: The proforma workbook used should be the same business type as the financial statement blank filed with the NAIC. |

|

Q24: Why are the spreadsheet cells password protected in the Proforma? A24: The proforma worksheet is a somewhat complicated form and it is extremely important not to accidentally overwrite the existing formulas. If copying or importing information into the proforma from another document, be sure to copy and “paste special” instead of just “paste”. Paste special will allow the option of selecting paste values only instead of paste formula. If paste is used the formulas imbedded in the excel spreadsheet will not work and you will need to begin the process over again or email your excel workbook to the NAIC to be reconfigured. |

|

Q1: Is an email address required on Form 14? A1: Yes. If the form asks for an email address, then the applicant should provide one. |

|

Q2: When submitting a Change of Statutory Home Office Address Corporate Amendment can a Change of Address/Contact Notification (Form 14) also be submitted within the same application? A2: Form 14, Change of Address/Contact Notification is a separate electronic application, but it can be included as an attachment for a Change of Statutory Home Office Address Corporate Amendment electronic application. Form 14 is located on the UCAA Web site as a Word doc. Complete this form, save to your hard drive and attach using the State Specific attachment button. |

|

Q3: Do I list my company phone number for change of mailing address on Form 14, Change of Mailing Address/Contact Notification Form? A3: No, list the company’s main administrative phone number. This should be the same number that is listed on the Jurat page of your company’s financial filings. |

at the top of the worksheet mean? Do the Macros have to be enabled to use the worksheet?

at the top of the worksheet mean? Do the Macros have to be enabled to use the worksheet?